Forex trading for beginners can feel overwhelming at first. New

traders are often confronted with unfamiliar terms, fast-moving prices, and a

market that operates around the clock. At Pipdemy, we approach Forex education

differently. We believe learning works best when concepts are explained

clearly, practiced in a safe environment, and reinforced through

experimentation rather than pressure or hype.

The Forex market plays a real and

important role in the global economy. It exists to facilitate international

trade, investment, and currency exchange. Retail traders participate in this

market on a much smaller scale, with the goal of understanding how currency

prices change and managing risk responsibly. This article is designed to help

beginners and early intermediate traders build a solid foundation. There are no

shortcuts here. Instead, you will learn how the market actually works, step by

step.

In this guide, you will learn what

Forex trading is, how currency pairs work, how price movement is measured, and

why market sessions matter. You will also be introduced to the mindset Pipdemy

promotes: learning through demo trading, structured practice, and, when

appropriate, AI-assisted experimentation rather than guesswork.

To begin any serious journey into

Forex, it is essential to clearly understand what is forex trading and

what it is not.

Forex trading is the act of exchanging

one currency for another at an agreed price. Unlike stock markets, where you

buy shares of a company, Forex trading always involves two currencies at the

same time. When you trade, you are expressing a view about the relative

strength or weakness of one currency compared to another.

For example, if you believe the euro

will strengthen against the US dollar, you might buy the EUR/USD currency pair.

If the euro rises relative to the dollar, the value of that position increases.

If it falls, the position loses value.

The Forex market exists primarily to

support:

- International trade (companies exchanging currencies

to pay for goods and services)

- Global investment flows (investors moving capital

between countries)

- Risk management and hedging (protecting against

unfavorable exchange rate changes)

Retail trading is a small component of

this ecosystem. Understanding this helps beginners avoid unrealistic

expectations. Forex is not designed to make people rich quickly. It is a

financial market where skill, discipline, and risk control matter over time.

Forex does not have a single physical

exchange. Trading happens electronically between banks, financial institutions,

brokers, and individual traders. This decentralized structure is why the market

operates 24 hours a day during the business week, following the sun across

major financial centers.

For beginners, this means

flexibility, but also responsibility. You are not required to trade constantly.

In fact, learning when not to trade is just as important as knowing when

to participate.

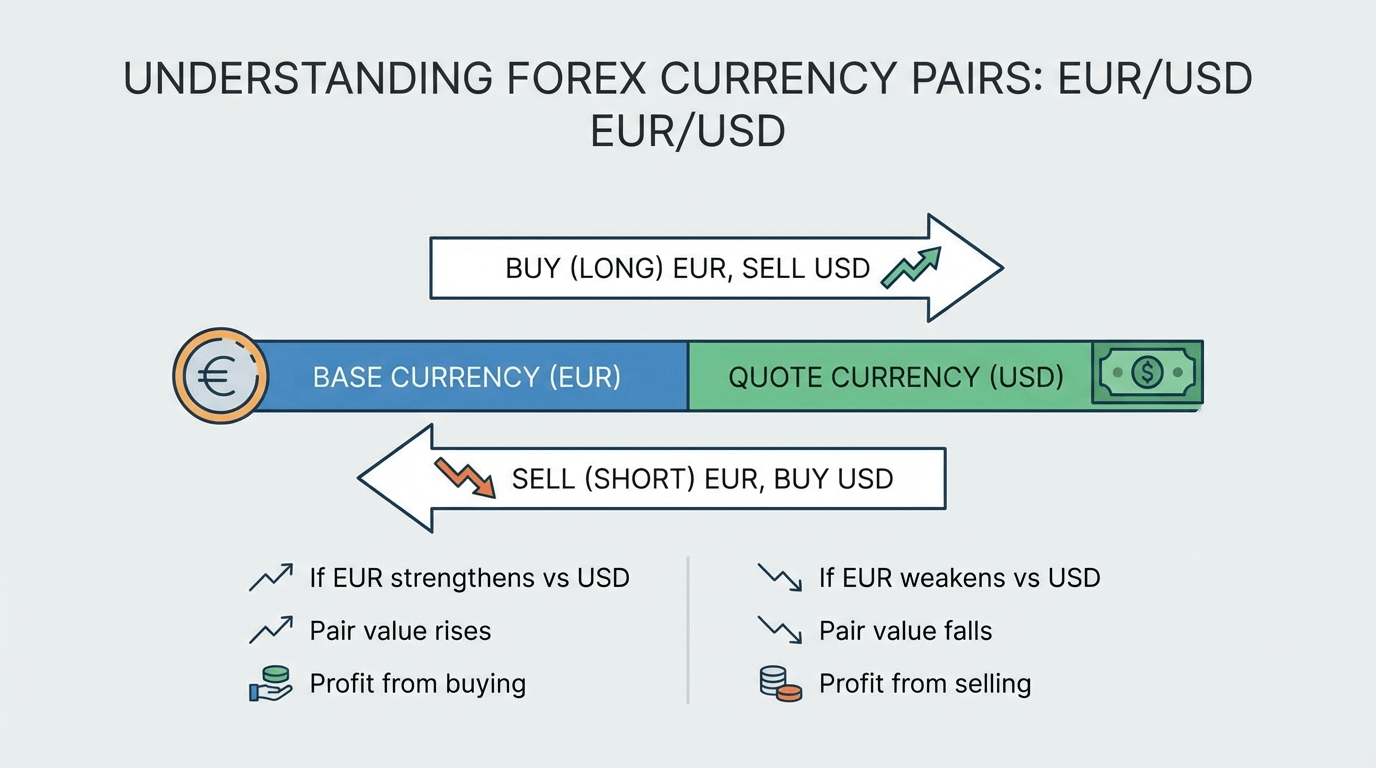

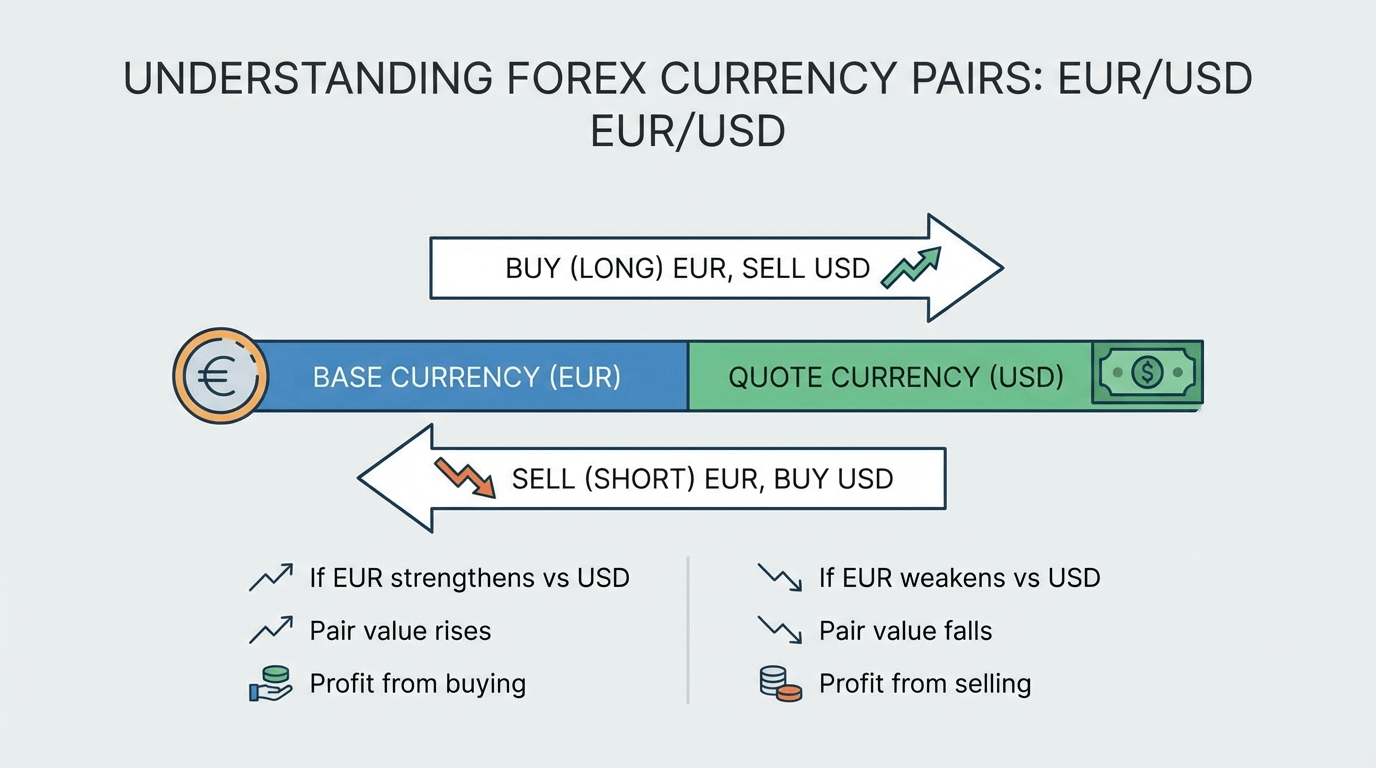

A core concept in Forex is

understanding how currency pairs work. Every trade involves buying one

currency while selling another simultaneously.

Each currency pair has two components:

• The base currency, which appears first

• The quote currency, which appears second

If a currency pair is quoted as EUR/USD at 1.1000, it means one euro is worth 1.10 US dollars. The price answers a simple question: how much of the quote currency is needed to buy one unit of the base currency?

When you trade:

• Buying the pair means you expect the base currency to strengthen

• Selling the pair means you expect the base currency to weaken

Currency pairs are grouped based on

liquidity and global significance.

- Major pairs include currencies from the

world’s largest economies and always involve the US dollar.

- Minor pairs do not include the US dollar but

still involve widely traded currencies.

- Exotic pairs combine a major currency with one

from a smaller or emerging economy.

For beginners, major pairs are usually

easier to understand and trade. They tend to have more predictable behavior,

lower transaction costs, and more educational material available.

At Pipdemy, most educational examples

and demo exercises start with major pairs. This allows learners to focus on

understanding market behavior without unnecessary complexity.

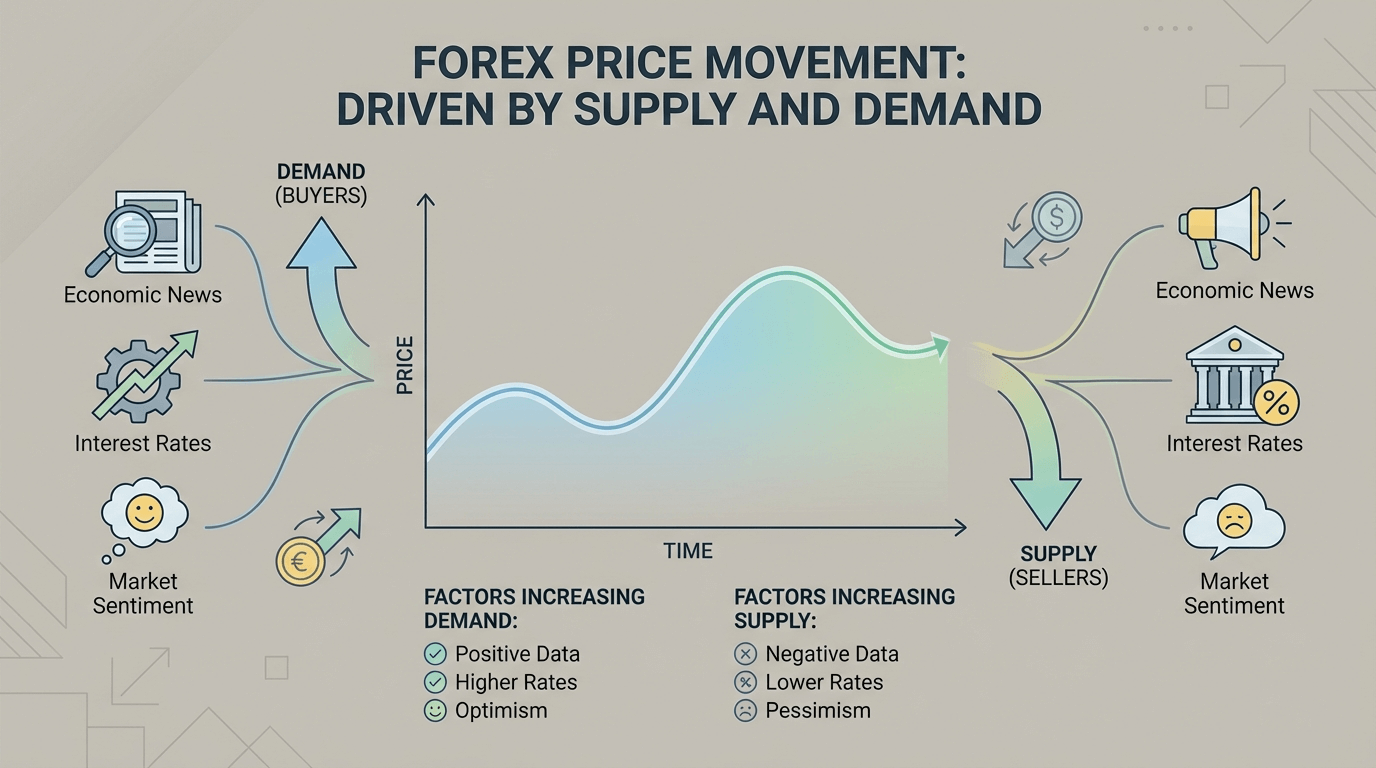

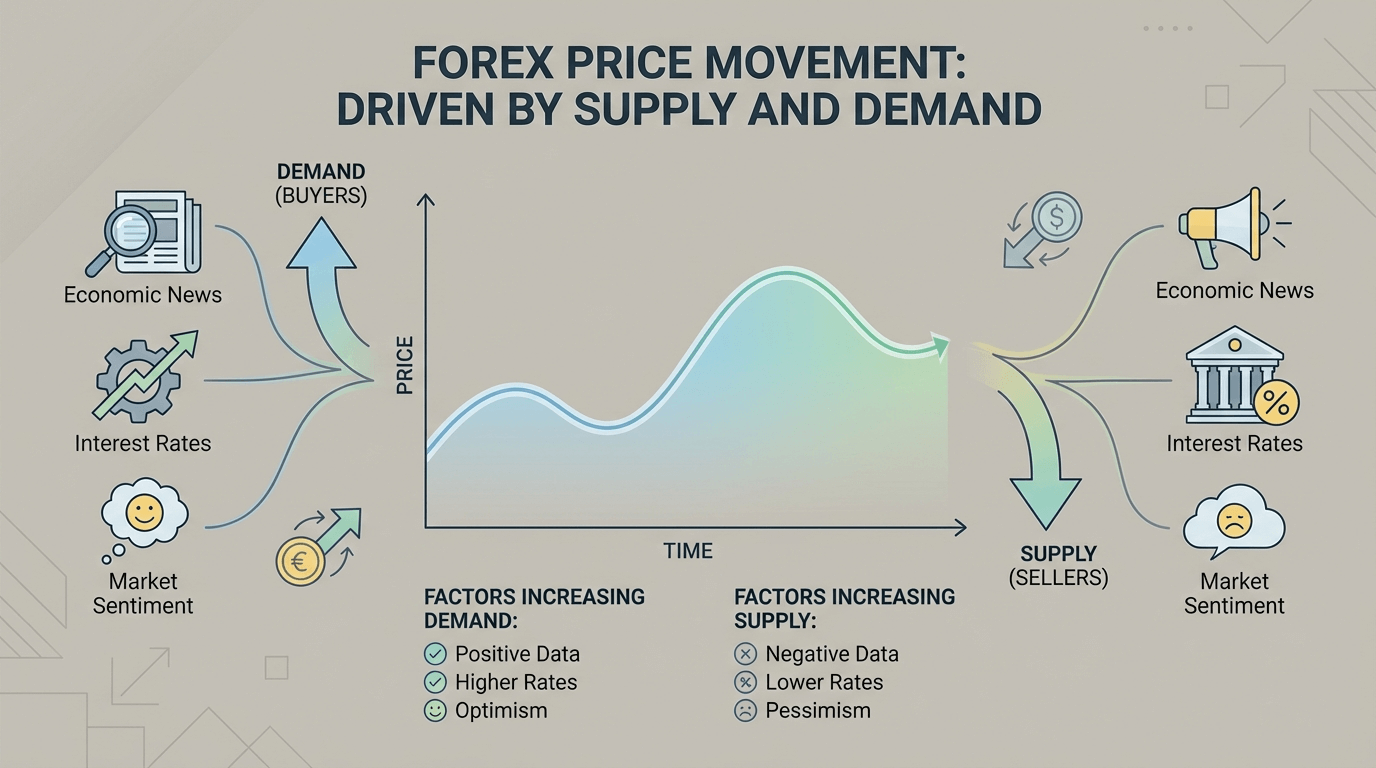

To trade responsibly, you must understand how forex prices move and why markets change direction.

At the most basic level, currency prices move because of supply and demand. When demand for a currency increases relative to another, its value rises. When demand weakens, its value falls.

This demand is shaped by many factors, including:

• Economic growth

• Interest rates

• Inflation expectations

• Political stability

• Market sentiment and expectations

Prices often move not on current conditions alone, but on expectations about the future. A central bank hinting at future policy changes can move markets even before anything officially happens.

Beginners are often surprised to see

prices move in a direction that seems to contradict the news. This usually

happens because the market had already priced in the information. Understanding

this dynamic takes time and exposure to real market behavior.

This is why Pipdemy emphasizes demo

trading and replay-based learning. Observing price reactions without financial

risk helps learners develop realistic expectations and avoid emotional

decision-making.

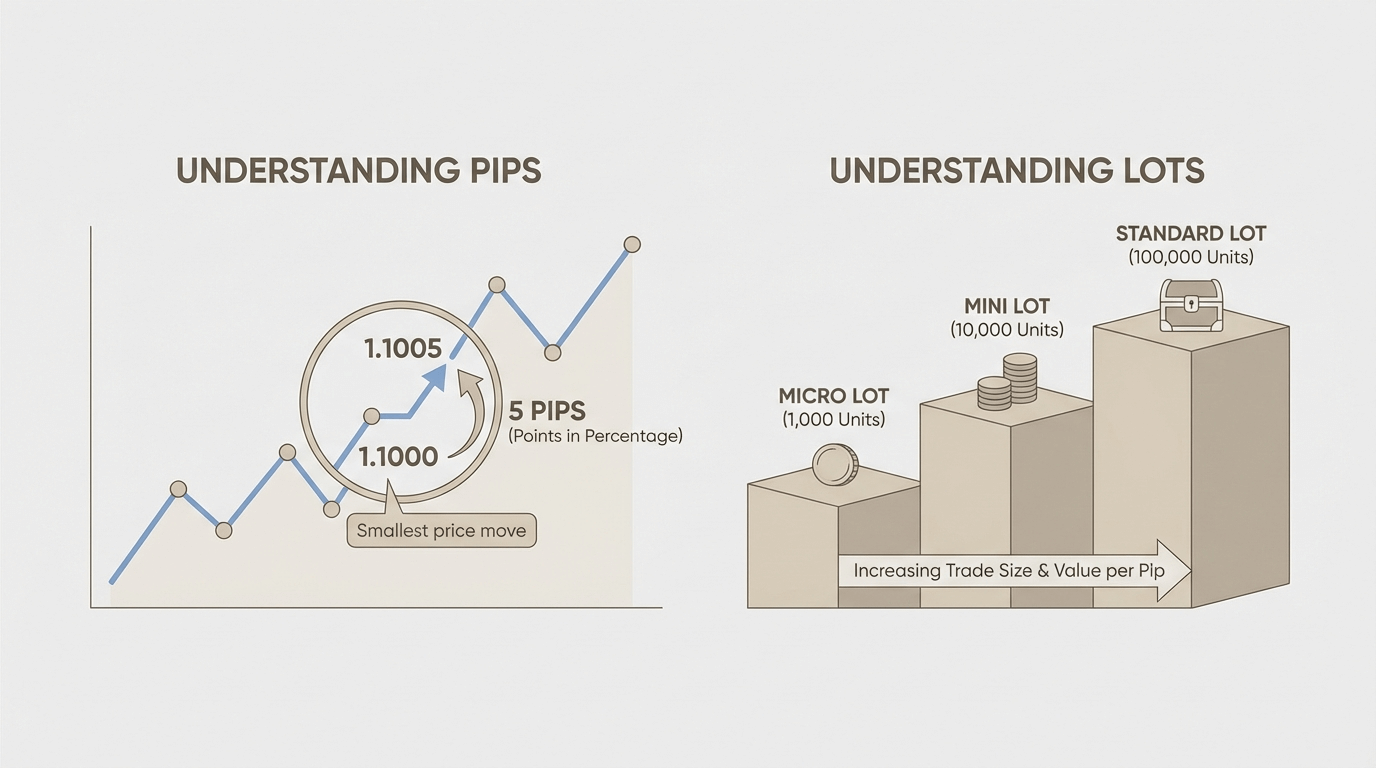

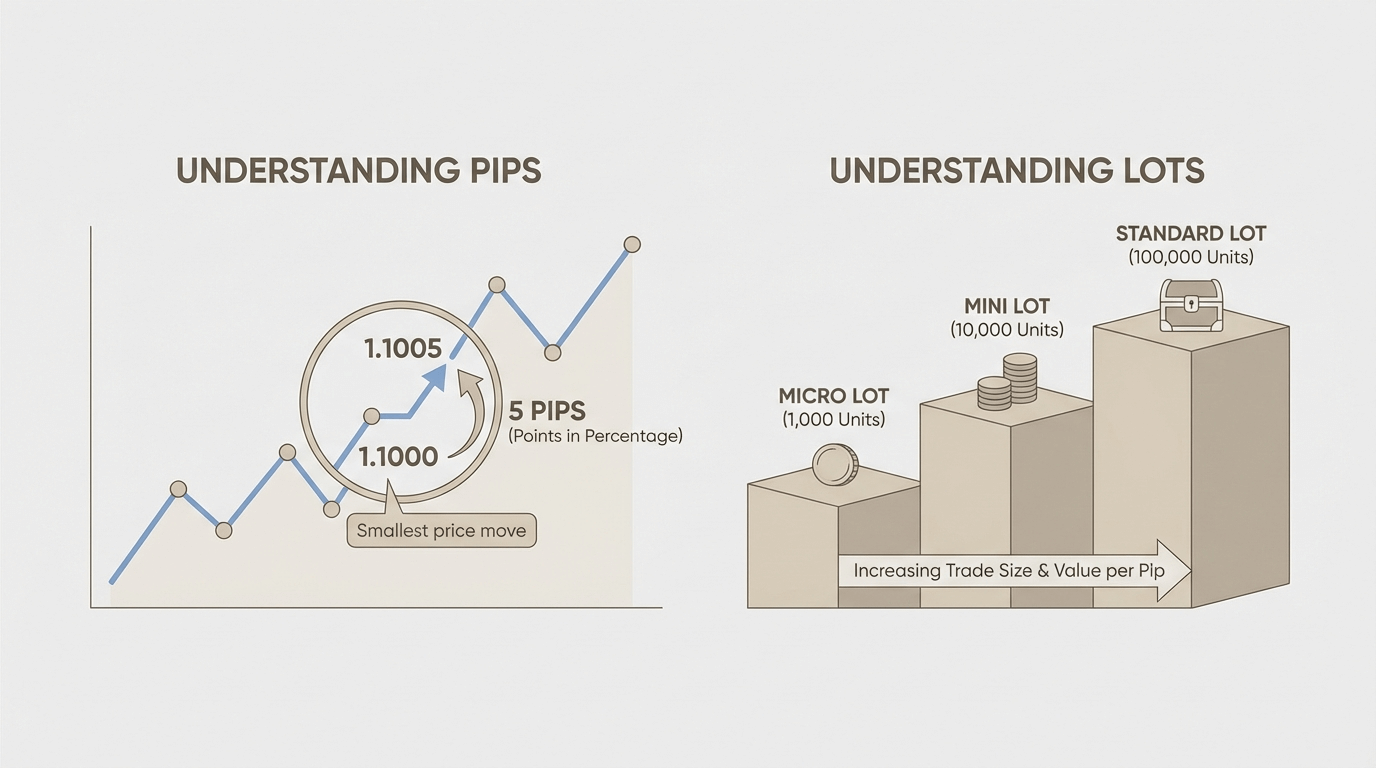

Two of the most important measurement

concepts in Forex are price movement and position size. This is where pips

and lots explained becomes essential knowledge.

A pip is a standardized unit used to

measure price changes in a currency pair. For most pairs, one pip equals a

movement in the fourth decimal place. For example, a move from 1.1000 to 1.1001

is one pip.

Pips allow traders to measure gains,

losses, and risk in a consistent way across trades. Whether you are trading

large or small amounts, pips provide a shared language for understanding

movement.

A lot represents the size of your

trade. It determines how much exposure you have to price movement.

Common lot sizes include:

- Standard lots

- Mini lots

- Micro lots

Beginners often underestimate how

important lot size is. Two traders can see the same price movement in pips and

have very different outcomes based on how large their position is.

At Pipdemy, learners are encouraged to

start with the smallest possible position sizes in demo environments. This

builds awareness of risk before any real capital is involved.

Learning Forex without practice is like

learning to drive by reading a manual alone. Demo trading allows beginners to

experience real market conditions without real financial consequences.

Demo accounts simulate live prices and

trading execution. They allow learners to:

- Practice placing trades

- Observe how prices behave during different market

conditions

- Test ideas without emotional pressure

At Pipdemy, demo trading is not treated

as a casual sandbox. It is structured as a learning laboratory. Learners are

guided to form simple hypotheses, test them repeatedly, and review results

objectively. This approach aligns naturally with AI-assisted analysis and

experimentation introduced later in the learning path.

For a structured approach to building

these foundational skills, Pipdemy integrates learning paths that connect

theory to practical experimentation through -.

Because Forex is global, understanding forex

market sessions explained is critical for timing and awareness.

The market is generally divided into

four major sessions:

- Sydney

- Tokyo

- London

- New York

Each session reflects the business

hours of its respective financial center. When one session closes, another

opens, keeping trading continuous.

Different sessions have different

characteristics:

- Some are more active

- Some have higher volatility

- Some see tighter or wider spreads

When sessions overlap, trading activity

often increases. This can lead to faster price movement but also higher risk.

Beginners benefit from observing these patterns in demo accounts before

attempting to trade them.

At Pipdemy, learners are taught that

activity does not equal opportunity. Sometimes the best decision is to wait for

clearer conditions rather than trade every session.

A strong mindset is just as important

as technical knowledge. Beginner traders often struggle not because they lack

intelligence, but because they lack structure and patience.

Some typical issues include:

- Trading too frequently

- Increasing position size after losses

- Chasing price instead of planning trades

- Ignoring risk limits

These behaviors are not signs of

failure. They are part of the learning curve. What matters is creating a system

that encourages reflection instead of emotional reactions.

Pipdemy emphasizes slow, deliberate

progress:

- Learn one concept at a time

- Practice it in a controlled environment

- Review results honestly

- Improve incrementally

AI tools, when used correctly, support

this process by helping traders analyze patterns and outcomes objectively. They

do not replace thinking or decision-making. They enhance feedback and learning

efficiency.

Learning Forex becomes much easier once

the language of the market feels familiar. A clear forex terminology

glossary helps beginners follow educational material, analyze charts, and

understand trading platforms without confusion. Below are essential terms

explained in simple, practical language.

- Bid price is the price at which the market is willing to buy

a currency pair.

- Ask price is the price at which the market is willing to sell

a currency pair.

The difference between these two prices

is called the spread. Beginners often overlook the spread, but it represents a

real trading cost that affects every position.

The spread is the gap between

the bid and ask price. Some currency pairs have tighter spreads due to higher

liquidity, while others are more expensive to trade. Understanding spreads

matters because a trade starts slightly negative due to this cost.

Leverage allows traders to control a larger

position with a smaller amount of capital. While leverage increases potential

gains, it also magnifies losses. For beginners, leverage should be approached

with caution and used conservatively, especially during the learning phase.

Margin is the amount of money required to

open and maintain a leveraged trade. It is not a fee, but a portion of your

account set aside as collateral. If losses grow too large, positions may be

closed automatically to prevent further losses.

Volatility refers to how much and how quickly

prices move. Highly volatile conditions can create opportunities, but they also

increase risk. Beginners often confuse volatility with opportunity, when in

reality it requires careful risk control.

Slippage happens when an order is executed at a

different price than expected, usually during fast market movements. It is a

normal part of live trading and something beginners should be aware of before

transitioning from demo to real accounts.

One of the most important lessons in Forex

trading for beginners is that learning how to manage risk matters more than

finding winning trades.

Many beginners focus heavily on market

direction while ignoring risk. This often leads to short-lived success followed

by significant losses. In reality, even experienced traders cannot predict the

market with certainty. What they can control is how much they risk on each

trade.

At Pipdemy, risk management is

introduced early and reinforced constantly. The goal is to survive long enough

to learn, not to win every trade.

Risk is closely tied to position size.

Trading larger lots than your account can reasonably support increases emotional

pressure and reduces decision quality. Starting small allows beginners to think

clearly and focus on process rather than fear.

A common educational principle is

risking only a small percentage of capital on any single trade. This keeps

losses manageable and protects the learning account from large drawdowns.

Losses are part of trading. The key

difference between productive learners and frustrated beginners is

interpretation. Productive learners treat losses as feedback. They review

execution, market conditions, and decision logic instead of reacting

emotionally.

Pipdemy encourages learners to track

trades, label mistakes, and test alternatives in demo environments. This

transforms losses into educational data points.

Reading about Forex concepts is

necessary, but it is not enough. Knowledge becomes useful only when tested in

real market conditions.

Demo trading allows learners to

practice without financial consequences. However, its value depends on how it

is used. Random trading teaches little. Structured experimentation teaches a

lot.

At Pipdemy, demo trading is framed as a

laboratory:

- Form a simple idea

- Test it repeatedly

- Record outcomes

- Adjust based on evidence

This experimental mindset prepares

traders for more advanced tools, including AI-assisted analysis, which relies

on data quality and disciplined testing.

AI does not replace thinking. It

supports it. When used responsibly, AI can help beginners identify patterns,

review trade behavior, and detect recurring mistakes. However, AI tools work

best when traders already understand the basics of price movement, risk, and

market structure.

This is why Pipdemy emphasizes

foundational education first. Without understanding concepts like pips, lots,

and sessions, AI outputs become confusing or misleading.

A sustainable Forex journey requires

structure. Jumping between strategies or copying trades without understanding

creates confusion rather than skill.

A healthy learning path typically

includes:

- Understanding market basics

- Practicing execution in demo accounts

- Learning simple risk management rules

- Reviewing results objectively

- Gradually increasing complexity only when ready

Pipdemy structures education around

this progression. Learners are encouraged to master each layer before moving

forward.

In Forex, patience itself is a skill.

Many losses come not from poor ideas, but from acting too early or too often.

Learning to wait for clarity and confirmation is part of becoming consistent.

This mindset separates

education-focused traders from those driven by urgency and emotion.